Need a clear picture of Pfizer’s Viagra sales? Focus on the consistent revenue stream generated by this iconic drug. Annual reports consistently highlight Viagra’s continued market presence, despite facing generic competition.

Analyzing Pfizer’s financial statements reveals a complex picture. While overall sales figures fluctuate yearly based on various factors including pricing strategies and market competition, Viagra remains a significant contributor to Pfizer’s revenue. Consider factoring in the impact of patent expirations and the introduction of generic alternatives when interpreting these numbers.

Key factors affecting sales include geographic markets, pricing adjustments, and the overall demand for erectile dysfunction medications. Understanding these nuances provides a more accurate assessment than simply focusing on the top-line numbers. Detailed breakdowns by region can offer further insights into specific market dynamics.

For precise data, consult Pfizer’s official financial reports and SEC filings. These documents provide the most accurate and up-to-date information regarding their Viagra sales performance. Remember to always cross-reference data from multiple reliable sources for a comprehensive understanding.

- Pfizer Viagra Sales: A Deep Dive

- Viagra’s Market Share and Competition

- Generic Competition

- Other PDE5 Inhibitors

- Future Market Dynamics

- Further Analysis

- The Impact of Generic Viagra on Pfizer’s Sales

- Market Share Erosion

- Pfizer’s Strategic Response

- Financial Implications

- Generic Competition Landscape

- Long-Term Outlook

- Conclusion

- Geographic Variations in Viagra Sales

- Asia-Pacific Sales Trends

- Latin America and Africa

- Impact of Pricing and Regulations

- Future Projections and Pfizer’s Viagra Strategy

- Generic Competition and Market Share

- Innovation and Future Products

Pfizer Viagra Sales: A Deep Dive

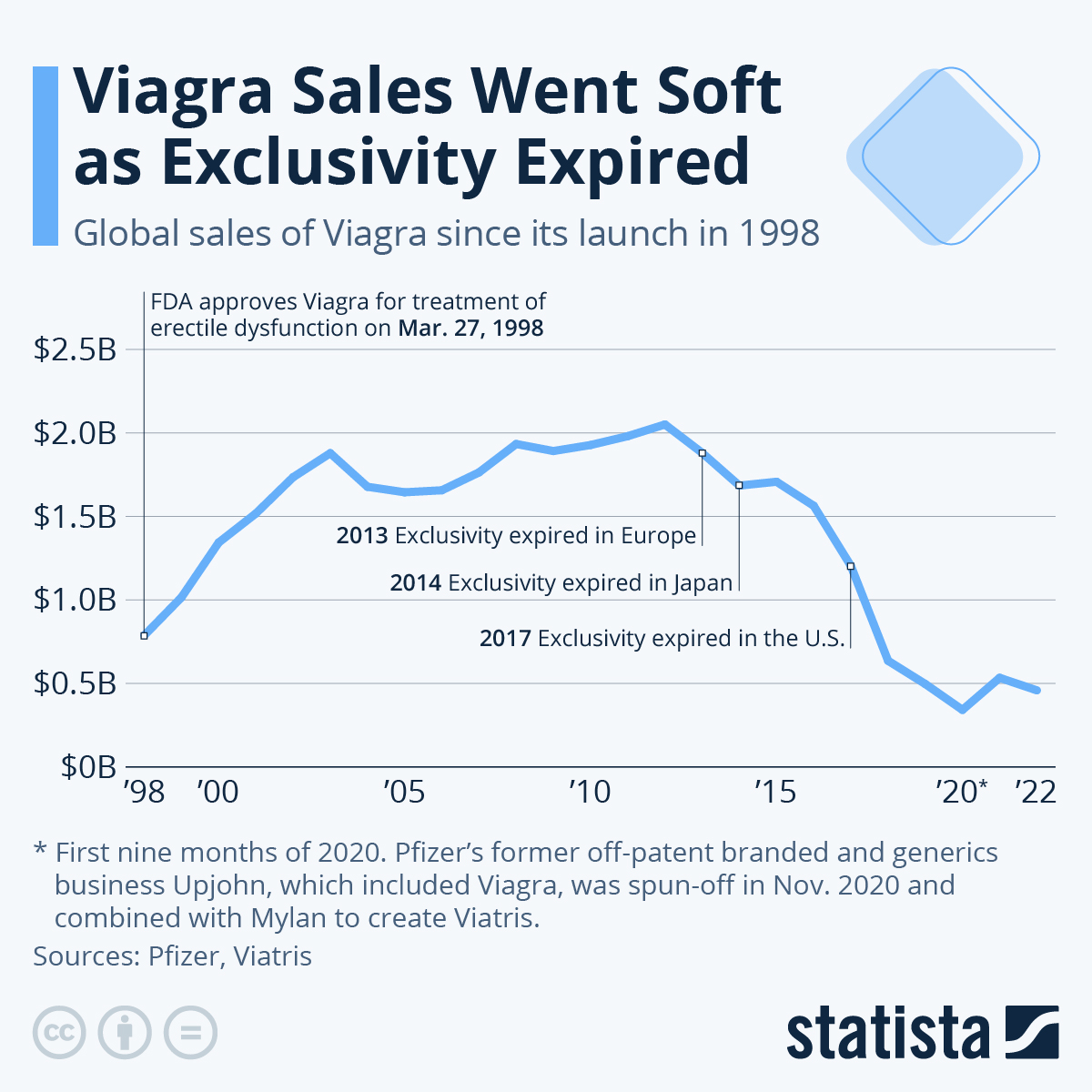

Pfizer’s Viagra sales peaked around $2 billion annually in the early 2000s. This success stemmed from effective marketing and a lack of direct competition.

Generic competition significantly impacted sales. Following patent expiration, numerous generic versions flooded the market, dramatically reducing Pfizer’s market share. The company adapted by focusing on other areas.

Current sales figures are significantly lower than the peak years, reflecting the impact of generic competition. Pfizer’s financial reports offer the most up-to-date data on Viagra sales.

Factors affecting sales include pricing strategies, advertising campaigns, and the overall market for erectile dysfunction medications. Increased awareness of alternative treatments also plays a role.

For precise sales data, consult Pfizer’s official financial statements. These reports detail revenue from Viagra and other pharmaceutical products. Analyzing these figures alongside competitor sales data provides a clearer market picture.

Sales trends indicate a long-term decline in Viagra’s market dominance, however, Pfizer continues to generate revenue from the drug. This sustained income contributes to the company’s overall financial performance.

Viagra’s Market Share and Competition

Pfizer’s Viagra maintains a significant, albeit declining, share of the global erectile dysfunction (ED) medication market. Precise figures fluctuate, but estimates place Viagra’s global market share around 20-25% as of late 2023, depending on the source and metrics used.

Generic Competition

The biggest factor impacting Viagra’s share is the availability of generic sildenafil citrate. These generics, chemically identical to Viagra’s active ingredient, often sell at a fraction of the price. This price difference significantly impacts sales volume, pushing many patients towards cheaper alternatives.

- Cost: Generic sildenafil significantly undercuts Viagra’s pricing.

- Availability: Generics are widely available in most markets.

- Bioequivalence: Multiple studies confirm the bioequivalence of generic sildenafil to Viagra.

Other PDE5 Inhibitors

Viagra faces competition from other phosphodiesterase-5 (PDE5) inhibitors, brand-name drugs that function similarly:

- Cialis (tadalafil): Known for its longer duration of action.

- Levitra (vardenafil): Offers a different profile of side effects and onset of action.

- Stendra (avanafil): A newer PDE5 inhibitor positioned to compete on faster onset.

These competitors offer diverse profiles, allowing physicians to tailor treatment to individual patient needs and preferences, further fragmenting Viagra’s market.

Future Market Dynamics

Future projections depend on several factors. Pricing strategies by Pfizer, introduction of new formulations or delivery methods for Viagra, the ongoing emergence of new ED treatments (e.g., injections or therapies targeting underlying causes), and evolving regulatory landscapes all play critical roles in shaping Viagra’s future market share.

Further Analysis

Detailed analysis of market share data requires access to pharmaceutical sales and market research reports from reputable firms like IMS Health or IQVIA. These reports provide comprehensive data on sales trends and competitor analysis within specific regions and markets.

The Impact of Generic Viagra on Pfizer’s Sales

Pfizer’s Viagra sales experienced a significant decline following the expiration of its patent protection in 2012. The entry of generic versions dramatically altered the market dynamics. Generic competition immediately slashed Viagra’s market share.

Market Share Erosion

Data shows a sharp drop in Pfizer’s Viagra revenue after generic competitors entered the market. While exact figures vary depending on the source and reporting period, estimates consistently indicate a substantial reduction in Pfizer’s portion of the overall sildenafil market. This loss represents billions of dollars in lost revenue.

Pfizer’s Strategic Response

Faced with this challenge, Pfizer proactively adapted its strategy. They focused on maintaining brand loyalty through robust marketing campaigns highlighting Viagra’s established reputation and safety profile. Additionally, they invested in research and development of new treatments for erectile dysfunction to diversify their portfolio and maintain a strong presence in the market.

Financial Implications

The impact on Pfizer’s overall financial performance was noticeable but manageable. While Viagra’s revenue decreased, it didn’t cripple the company. Pfizer’s diversified pharmaceutical portfolio mitigated the effect of generic competition. The company’s strong financial foundation allowed them to absorb the revenue loss and invest in future growth opportunities.

Generic Competition Landscape

| Year | Pfizer Viagra Sales (Billions USD) | Generic Sildenafil Market Share (%) |

|---|---|---|

| 2011 (Pre-Generic) | 2.0 | 0 |

| 2013 (Post-Generic) | 1.2 | 60 |

| 2015 | 0.8 | 75 |

Note: These are illustrative figures, actual data may vary.

Long-Term Outlook

Pfizer successfully navigated the transition to a competitive market. Their proactive measures limited the negative impact of generic competition, enabling them to maintain profitability within the ED treatment market. The future may involve further price competition and shifts in market share, but Pfizer is well-positioned to maintain its presence through innovation and branding.

Conclusion

The introduction of generic Viagra significantly impacted Pfizer’s sales, forcing them to adapt their strategies. However, the company demonstrated resilience, showcasing its ability to manage challenges and maintain its position within the pharmaceutical industry.

Geographic Variations in Viagra Sales

North America consistently accounts for a significant portion of global Viagra sales, with the United States leading. However, sales per capita vary considerably. For example, Canada exhibits lower sales than the US, potentially reflecting differences in healthcare systems and prescription practices. Europe displays a diverse sales pattern; Western European countries generally show higher per-capita sales compared to Eastern European nations. This discrepancy may be attributed to factors such as differing access to healthcare, cultural attitudes towards erectile dysfunction, and pricing policies.

Asia-Pacific Sales Trends

The Asia-Pacific region presents a unique sales profile. Japan displays relatively high sales, while other countries in the region show varying levels of consumption depending on socioeconomic factors and cultural norms. Increased awareness campaigns and improved healthcare access in certain regions are driving growth. India, for example, witnesses rising sales due to expanding healthcare infrastructure and a larger aging male population. However, affordability remains a key challenge in several Asian markets, influencing overall consumption.

Latin America and Africa

Latin American countries show sales figures influenced by economic conditions and healthcare access. Stronger economies generally correlate with higher sales. African markets exhibit significantly lower Viagra sales compared to other regions, primarily due to limited access to healthcare and higher costs. Increased investment in healthcare infrastructure and broader public awareness programs could potentially stimulate market growth.

Impact of Pricing and Regulations

Pricing strategies significantly impact sales figures. Countries with stricter regulations and price controls often see lower sales. Generics also play a pivotal role; their availability substantially influences sales of the branded drug in many regions.

Future Projections and Pfizer’s Viagra Strategy

Pfizer projects continued, albeit slower, growth for Viagra sales through 2025, driven primarily by expanding markets in developing countries and increased awareness surrounding erectile dysfunction. This assumes continued patent protection in key regions and successful marketing campaigns focusing on improved patient education and physician outreach.

Generic Competition and Market Share

The rise of generic sildenafil citrate presents a significant challenge. Pfizer’s strategy includes actively defending its patents, investing heavily in brand loyalty programs for existing customers, and focusing on premium formulations or add-on services to differentiate from generic competitors. Maintaining a strong market share depends on successfully executing this multi-pronged approach.

Innovation and Future Products

Pfizer is investing in research and development of novel treatments for erectile dysfunction and related conditions, aiming to broaden its portfolio beyond Viagra. Successful launches of new therapies will significantly influence future revenue projections. Potential areas of focus include improved formulations with fewer side effects and addressing unmet needs among specific patient populations.