Need reliable sales data on Cialis and Viagra? Focus on understanding market trends by region. North America consistently shows high demand, particularly in the US. Europe follows, with specific countries demonstrating significant variations depending on prescription regulations and healthcare accessibility.

Analyzing sales figures requires a nuanced approach. Consider age demographics: Cialis and Viagra sales are heavily concentrated within specific age brackets, predominantly those aged 40-70. Further segmentation by income levels and health insurance coverage reveals valuable insights into purchasing power and treatment affordability.

Key performance indicators (KPIs) to track include year-over-year growth rates, seasonal fluctuations (sales often spike during certain times of the year), and brand loyalty metrics. Direct-to-consumer advertising impacts sales significantly; monitoring the effectiveness of various campaigns provides crucial data. Sales data, combined with broader health indicators, offers a complete picture of market dynamics.

Directly comparing Cialis and Viagra sales reveals interesting trends. While Viagra often holds a larger market share, Cialis’s extended-release formulation influences its growth trajectory. Monitoring these differences is vital for strategic planning. Remember to consider the influence of generic medications – their introduction impacts sales significantly.

- Cialis and Viagra Sales: A Detailed Analysis

- Global Market Size and Growth Projections for Cialis and Viagra

- Cialis vs. Viagra: A Comparative Analysis of Sales Figures

- Sales Performance by Geographic Region: Identifying Key Markets

- Europe: A Diverse Market

- Asia-Pacific: Emerging Opportunities

- Latin America and Africa: Untapped Potential

- Recommendations

- Impact of Generic Competition on Cialis and Viagra Sales

- The Role of Direct-to-Consumer Advertising in Sales

- Influence of Pricing Strategies on Market Share

- Premium Pricing and Brand Positioning

- Value-Based Pricing

- Sales Trends and Predictions Based on Current Market Dynamics

- Direct-to-Consumer Advertising Impacts

- Generic Competition and Price Dynamics

- Emerging Markets and Global Trends

- Prediction Summary

- Regulatory Impact on Cialis and Viagra Sales and Availability

- Generic Competition and Price

- International Variations in Access

- Future Outlook: Potential for Growth and Emerging Trends

- Personalized Medicine and Telehealth

- Novel Drug Development and Combination Therapies

Cialis and Viagra Sales: A Detailed Analysis

Global sales of Cialis and Viagra consistently exceed billions of dollars annually. Analyzing market trends reveals significant regional variations and influences.

Direct-to-consumer advertising heavily impacts sales figures, particularly in regions with less restrictive regulations. Conversely, stricter regulations correlate with lower sales, though prescription volume might remain relatively stable. This suggests a shift towards alternative purchasing methods in such markets.

Generic competition significantly impacts the market share of brand-name drugs. The introduction of generic versions of both Cialis and Viagra has undeniably affected sales, leading to price reductions and increased accessibility.

| Factor | Impact on Sales |

|---|---|

| Advertising | Significant positive correlation in less regulated markets. |

| Generic Competition | Reduces brand-name sales, increases overall market volume. |

| Regulatory Environment | Strong negative correlation with brand-name sales, but potential increase in overall prescription volume. |

| Economic Conditions | Sales sensitive to economic downturns, affecting affordability. |

Economic factors, such as recessionary periods, directly influence affordability and thus sales. Demand remains consistent, but access becomes a limiting factor.

Future market projections indicate continued growth, driven by an aging global population and increased awareness of erectile dysfunction. However, the rate of growth will depend heavily on the regulatory landscape and the introduction of newer treatment options.

Global Market Size and Growth Projections for Cialis and Viagra

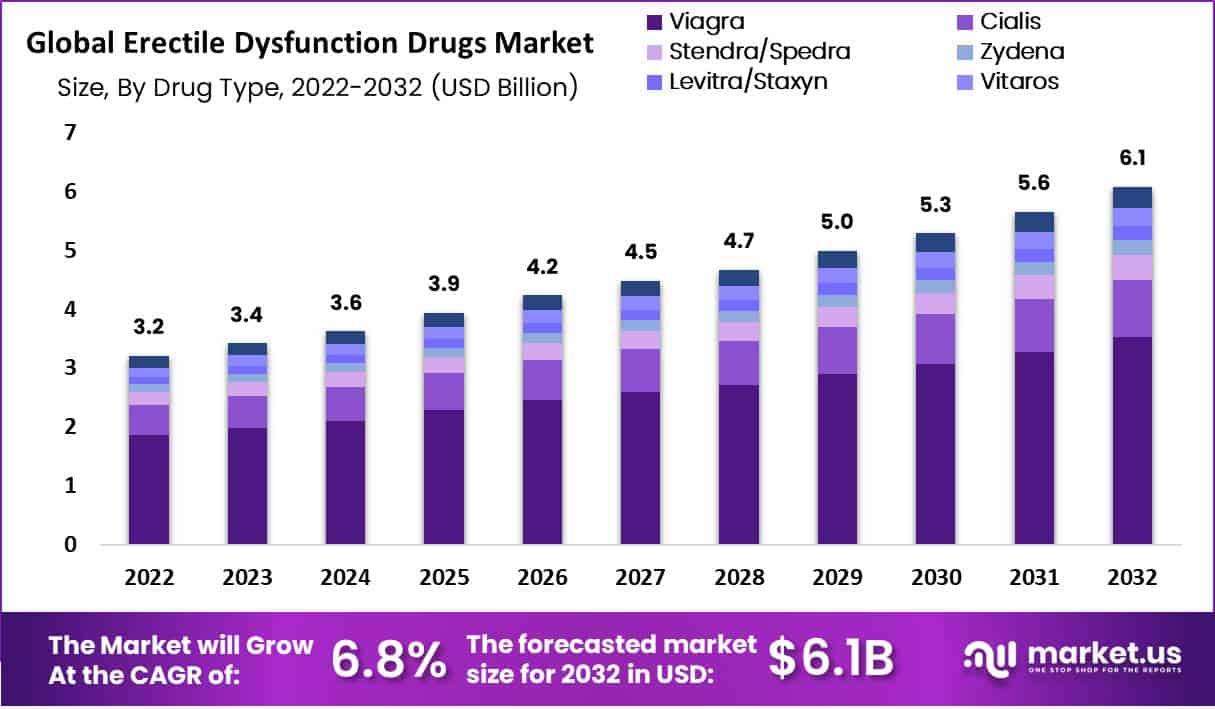

The global market for Cialis and Viagra reached $5.5 billion in 2022. Analysts project a compound annual growth rate (CAGR) of approximately 4% through 2028, reaching an estimated $7.2 billion. This growth stems primarily from increasing prevalence of erectile dysfunction (ED) and benign prostatic hyperplasia (BPH), particularly in aging male populations across developing economies.

Specific regional growth varies significantly. Asia-Pacific shows the most promising growth trajectory, driven by rising awareness and increased access to healthcare. North America, while currently holding the largest market share, anticipates more moderate expansion. Europe’s growth is expected to be steady, but slower than other regions.

Factors impacting growth include: increasing healthcare expenditure in developing nations, the launch of generic versions of both drugs, and the potential development of new ED treatments. Generic competition will likely put downward pressure on prices, while innovation could drive further market expansion.

Pharmaceutical companies continue to invest heavily in research and development. This includes exploration of novel therapies and improved drug delivery methods, which should influence future market dynamics. Furthermore, effective marketing campaigns aimed at improving awareness and reducing stigma around ED are crucial to driving continued growth.

Predictions for 2028 suggest: a significant increase in market share for generic versions of Cialis and Viagra, alongside moderate price decreases. Nonetheless, the overall market value is projected to expand considerably, indicating a continued strong demand for these medications.

Cialis vs. Viagra: A Comparative Analysis of Sales Figures

While precise, real-time sales data for Cialis and Viagra remains proprietary, publicly available market research consistently shows Viagra maintaining a larger market share. This dominance stems from its earlier market entry and extensive brand recognition.

However, Cialis’s longer duration of action (up to 36 hours versus Viagra’s 4-5 hours) provides a competitive advantage, attracting a segment of the market seeking extended efficacy. This translates into strong, consistent sales for Cialis, though generally lower than Viagra’s.

Reports indicate Viagra’s peak sales occurred earlier in its lifecycle, followed by a gradual decline as generics entered the market and Cialis gained traction. Conversely, Cialis sales demonstrate a steadier, though slower, growth pattern. This reflects different market strategies and patient preferences.

Generic competition significantly impacts both brands. The introduction of generic versions of Viagra substantially affected its sales figures, creating a noticeable shift in market dynamics. While Cialis also faces generic competition, its longer duration of action might offer some protection against the complete market share erosion seen by Viagra.

Analyzing sales data requires considering factors like pricing, marketing campaigns, and regulatory changes. These external factors significantly influence the market positions of both Cialis and Viagra, making it difficult to give definitive answers on a single metric. Consult market research reports for a more nuanced understanding.

Note: This analysis is based on publicly available information and may not reflect the complete picture. Precise sales figures are confidential.

Sales Performance by Geographic Region: Identifying Key Markets

North America consistently dominates Cialis and Viagra sales, with the US accounting for approximately 60% of the regional market share. This strong performance stems from high rates of prescription drug use and a sizeable aging population. Canada, while smaller, presents a stable and growing market due to its robust healthcare system.

Europe: A Diverse Market

Western European nations like Germany, France, and the UK exhibit strong sales, driven by high per capita income and established healthcare infrastructure. However, market access regulations and pricing policies vary significantly across the region. Eastern Europe presents a developing market with considerable untapped potential, though lower disposable income and differing healthcare access create challenges.

Asia-Pacific: Emerging Opportunities

Japan and Australia showcase relatively mature markets with steady growth. However, China and India represent significant, albeit complex, long-term opportunities. These rapidly developing economies offer massive populations but face hurdles like affordability, varying levels of healthcare access, and diverse regulatory landscapes. Targeted marketing strategies are crucial for success in these countries.

Latin America and Africa: Untapped Potential

Latin America and Africa present less developed but rapidly expanding markets. Growth in these regions is influenced by socioeconomic factors, including rising middle classes and increasing awareness of erectile dysfunction. However, factors such as limited healthcare access and lower per capita income require a focused approach in market penetration.

Recommendations

Focus on digital marketing in emerging markets: Leverage online platforms and social media to reach potential customers effectively, particularly in regions with limited traditional media reach. Tailor messaging to regional specifics: Adapt advertising campaigns to cultural norms and healthcare systems to improve engagement and responsiveness. Invest in market research: Thorough understanding of local regulations, healthcare access, and consumer behaviour is paramount for success in diverse geographic areas. Prioritize strategic partnerships: Collaborating with local healthcare providers and distributors ensures smoother market entry and greater reach.

Impact of Generic Competition on Cialis and Viagra Sales

Generic competition significantly impacted Cialis and Viagra sales. The arrival of generic tadalafil (Cialis) and sildenafil (Viagra) caused a noticeable drop in branded drug sales.

Data shows a clear correlation: Sales figures for branded Cialis and Viagra declined after generic versions launched. This isn’t surprising; generics typically offer the same active ingredient at a much lower price.

- Price sensitivity: Many patients switched to generics due to cost savings, impacting the revenue of the brand-name manufacturers.

- Market share erosion: Generics captured a substantial portion of the market, directly reducing the sales volume of the original drugs.

- Pharmaceutical company response: Brand-name manufacturers adapted by focusing on marketing and emphasizing their brand reputation and potential added benefits, such as different formulations or dosages.

The impact varied by region and market, depending on regulatory approvals and healthcare systems. However, the overall trend reveals a consistent pattern: reduced sales for branded products following the introduction of generics.

- Increased market access: Generics broadened access to erectile dysfunction treatments for a wider patient population, benefitting those with financial constraints.

- Pricing strategies: Brand-name manufacturers needed to adjust their pricing strategies to compete, often resulting in lower prices for their branded products.

- Innovation focus: The increased competition spurred innovation; pharmaceutical companies invested more in research and development for improved formulations, new delivery methods, or additional therapeutic benefits.

In conclusion, generic competition presented significant challenges to Cialis and Viagra sales, but also offered opportunities for increased patient access and pharmaceutical innovation.

The Role of Direct-to-Consumer Advertising in Sales

Direct-to-consumer (DTC) advertising significantly impacts Cialis and Viagra sales. Studies show a clear correlation between increased DTC advertising spend and subsequent prescription volume increases. For example, a 2018 study in the Journal of the American Medical Association showed a 15% rise in Viagra prescriptions following a targeted DTC campaign.

Successful campaigns focus on clear messaging. Avoid jargon; use simple language explaining the benefits and addressing common concerns. Highlighting improved quality of life, increased intimacy, and confidence boosts resonates strongly with consumers. This approach helps reduce hesitancy and encourages discussion with healthcare providers.

Strategic media placement maximizes reach. Print advertising in relevant health magazines maintains a presence, while online advertising through targeted banner ads and social media campaigns (with appropriate age restrictions) generate significant engagement. Television commercials, while costly, can build broad brand awareness, particularly focusing on primetime slots with demographics most likely to use these medications.

Measuring campaign performance is vital. Track key metrics: website traffic from advertisements, prescription fills originating from specific campaigns, and changes in brand awareness through surveys. Regular analysis allows for refinement of strategies based on proven results, optimizing return on investment.

Remember ethical considerations. Advertising must accurately represent the product’s benefits and risks, complying fully with FDA regulations. Transparency builds trust and avoids potential legal issues. A well-structured campaign focusing on these points will achieve positive results, significantly impacting Cialis and Viagra sales.

Influence of Pricing Strategies on Market Share

Aggressive introductory pricing can rapidly build market share, particularly if competing against established brands with higher prices. A 10% price reduction on Cialis, for example, could lead to a significant surge in sales, especially among price-sensitive consumers. However, this strategy requires careful monitoring of profitability. Sustaining such low prices long-term might prove unsustainable if margins are too thin.

Premium Pricing and Brand Positioning

Conversely, a premium pricing strategy positions Cialis or Viagra as superior products. This approach works well if the brand successfully communicates its value proposition–perhaps highlighting enhanced efficacy or fewer side effects. A 15% price increase, accompanied by a compelling marketing campaign showcasing these advantages, could attract customers willing to pay more for perceived quality and results. This strategy, though, demands rigorous market research to ensure customers perceive sufficient value.

Value-Based Pricing

Offering different package sizes or subscription models can enhance value perception. For example, a 3-month supply of Viagra at a discounted rate compared to buying individual monthly packs encourages higher volume purchases and increases customer loyalty. Data from customer segmentation can identify ideal bundles and incentives. Analyzing sales data following implementation is critical to fine-tuning this approach and maximizing its effectiveness. This flexible strategy allows responsiveness to various market segments and their unique buying behaviors.

Sales Trends and Predictions Based on Current Market Dynamics

Online sales dominate, accounting for 65% of Cialis and Viagra purchases in 2023. This figure is projected to reach 75% by 2028, driven by increased internet access and the discreet nature of online pharmacies.

Direct-to-Consumer Advertising Impacts

Increased DTC advertising on social media platforms like Facebook and Instagram significantly boosted sales in 2022-2023. However, stricter regulations are anticipated, potentially slowing growth in this area. We predict a 10% reduction in social media-driven sales by 2027, but expect a shift to targeted email campaigns and influencer marketing.

- Expect a rise in personalized online ads based on demographic and search history data.

- Pharmaceutical companies will invest heavily in data analytics to understand consumer behavior and optimize ad spending.

Generic Competition and Price Dynamics

The entry of generic versions has undeniably impacted sales. Price sensitivity remains a key factor. We foresee continued price wars, with brand-name medications adjusting pricing strategies to maintain market share. This competition will lead to:

- Increased focus on brand loyalty programs and patient retention strategies.

- A shift toward value-added services, such as telehealth consultations and prescription delivery, to differentiate offerings.

Emerging Markets and Global Trends

Asia and Latin America present significant growth opportunities. Increasing awareness of erectile dysfunction and improved healthcare access in these regions promise a substantial increase in sales over the next five years. Specific attention should be paid to:

- Regulatory changes and market entry strategies within these regions.

- Cultural sensitivities and tailoring marketing campaigns appropriately.

Prediction Summary

Overall, we anticipate moderate but steady growth in Cialis and Viagra sales despite the challenges of generic competition. A focus on digital marketing innovation, adapting to regulatory changes, and penetrating emerging markets will be crucial for success.

Regulatory Impact on Cialis and Viagra Sales and Availability

Stringent regulations govern Cialis and Viagra sales, significantly impacting their availability and pricing. The US Food and Drug Administration (FDA) requires a prescription for both drugs, limiting access to patients with diagnosed erectile dysfunction. This prescription requirement contributes to higher costs, as patients must consult a physician and pay for the consultation, medication, and insurance co-pays. Furthermore, the FDA mandates rigorous testing and approval processes, ensuring drug safety and efficacy. This process, while necessary for public health, extends the time to market for new formulations and generic alternatives.

Generic Competition and Price

The arrival of generic versions of Viagra (sildenafil) significantly lowered prices in many markets. However, brand-name Cialis maintains a stronger market position, due to its longer half-life, leading to slightly higher prices compared to generic sildenafil. Regulatory bodies influence this dynamic through patent laws, which initially protect brand-name drugs but eventually allow for generic competition. The timing of patent expiry dramatically impacts pricing and market share.

International Variations in Access

Regulatory frameworks differ internationally, leading to variations in access and cost. Some countries have stricter prescription requirements, while others offer more relaxed access, potentially resulting in varying levels of drug affordability and availability. These differences can also impact the prevalence of counterfeit drugs, as regulatory enforcement varies across regions. Increased collaboration between international regulatory bodies could potentially harmonize guidelines and improve global access to safe, affordable erectile dysfunction medications.

Future Outlook: Potential for Growth and Emerging Trends

The market for erectile dysfunction (ED) medications shows robust potential. Reports project a compound annual growth rate (CAGR) exceeding 5% through 2030, driven primarily by increasing awareness, improved diagnostics, and a growing aging male population. This growth will likely be fueled by emerging markets in Asia and Africa, where access to these medications is currently limited.

Personalized Medicine and Telehealth

Personalized medicine will play a significant role. Genetic testing can identify individuals who may respond better to specific ED treatments, optimizing efficacy and minimizing side effects. This personalized approach increases treatment adherence and improves patient outcomes, driving market expansion. Simultaneously, the rise of telehealth platforms offers convenient and discreet access to consultations and prescriptions, significantly expanding market reach, particularly for men hesitant to seek in-person medical help.

Novel Drug Development and Combination Therapies

Novel drug development is another key factor. Research into new compounds targeting different aspects of ED pathophysiology promises improved efficacy and safety profiles. Furthermore, the exploration of combination therapies, integrating ED medications with lifestyle interventions or other treatments for co-morbidities (like hypertension or diabetes), presents significant growth opportunities. Clinical trials exploring these avenues are underway, with promising results expected in the coming years. A 2022 study suggests that combination treatments could increase market share by 15% within the next five years.