Start with a provincial health card! This provides access to publicly funded healthcare services, covering doctor visits, hospital stays, and many diagnostic tests. Remember to renew it promptly when needed; provincial websites provide clear instructions.

Understand your coverage. While the system covers many services, prescription drugs are a notable exception. Provincial drug plans offer partial coverage for specific medications, based on age, income, and condition. Explore your options – supplemental insurance from employers or private companies can bridge the gap.

Find a family doctor. This is your first point of contact for healthcare. Many provinces use online registries; check your province’s website for details. Consider location, language, and specialization when choosing. Building a relationship with your doctor is key to proactive healthcare.

Utilize telehealth services. Many provinces offer virtual consultations, saving you time and travel. This option is particularly beneficial for follow-up appointments or managing chronic conditions. Online booking systems simplify scheduling appointments and managing your healthcare.

Stay informed. Healthcare policies and procedures can change. Regularly check your provincial government’s health website for updates. Understanding your rights and responsibilities ensures a smoother experience within the Canadian healthcare system.

- Canadian Healthcare: A Comprehensive Overview

- Provincial Health Insurance Plans

- Beyond Public Coverage

- Finding a Doctor

- Eligibility and Coverage: Who Qualifies for Canadian Healthcare?

- Residency Requirements

- Waiting Periods and Exceptions

- Coverage Details

- Provincial Variations

- Contacting Provincial Health Ministries

- Accessing Healthcare Services: Navigating the System

- Understanding Health Cards

- Emergency Services

- Provincial Variations: Differences in Healthcare Delivery Across Canada

- Prescription Drug Coverage: Understanding the Gaps in the System

- Provincial Programs: A Patchwork Approach

- The Private Insurance Landscape

- High-Cost Medications: A Major Concern

- Funding and Sustainability: Challenges Facing Canadian Healthcare

- Addressing the Physician Shortage

- Optimizing Resource Allocation

- Improving Drug Pricing

- Alternative Healthcare Options: Private Insurance and Complementary Medicine

- Complementary Medicine Options

- Finding Practitioners and Insurance

- Financial Considerations

Canadian Healthcare: A Comprehensive Overview

Canadians access healthcare through a publicly funded system, meaning the government covers most medical services. This is primarily financed through general taxation. Expect universal coverage for medically necessary services, including doctor visits, hospital stays, and many diagnostic tests.

Provincial and territorial governments administer the system, leading to some variations in service delivery and wait times. For example, wait times for specialist appointments can vary significantly across provinces. Consider your location when assessing access to specific services.

Provincial Health Insurance Plans

Each province and territory operates its own health insurance plan. These plans cover medically necessary hospital and physician services. You obtain coverage through your province or territory of residence; residents typically register automatically. However, specific eligibility criteria and registration processes differ.

Beyond Public Coverage

While the public system covers a wide range of services, some things are not included. Dental care, vision care, and prescription drugs are commonly excluded, though some provinces offer limited drug coverage for specific populations. Private health insurance supplements public coverage for services not included, and may shorten wait times for certain procedures. Many employers offer private health insurance as an employee benefit.

Finding a Doctor

Finding a family doctor can take time, particularly in some urban areas. Health care providers can offer referrals; online search tools are another option. Many provinces have patient registries connecting patients with available doctors. Be patient and proactive in your search.

Eligibility and Coverage: Who Qualifies for Canadian Healthcare?

Canadian healthcare is primarily funded by provincial and territorial governments. To receive coverage, you must be a legal resident of a province or territory.

Residency Requirements

- Citizenship: Canadian citizens automatically qualify.

- Permanent Residents: Permanent residents gain access upon arrival. Their provincial health card is usually issued shortly after becoming a permanent resident.

- Temporary Residents: Coverage varies. Some temporary residents, such as international students or workers on specific visas, are eligible for provincial health insurance after a waiting period (usually three months). Check provincial guidelines for details.

Your provincial or territorial government administers the healthcare plan. You apply for a health card through them.

Waiting Periods and Exceptions

- Most provinces impose a waiting period of three months. This applies to many temporary residents.

- Emergency medical care is usually covered immediately, regardless of residency status.

- Some provinces have specific agreements with other provinces or territories, allowing for immediate coverage in certain circumstances.

To determine eligibility and understand the specific requirements for your situation, contact your provincial or territorial health ministry. Their websites generally offer clear and detailed information on coverage and application procedures.

Coverage Details

Provincial healthcare plans generally cover medically necessary hospital and physician services. This includes doctor visits, hospital stays, and some diagnostic testing. However, certain services, like dental care, vision care, and prescription drugs, are typically not included. These might be covered by supplementary private insurance or through provincial programs for low-income individuals.

Provincial Variations

Contacting Provincial Health Ministries

Each province and territory has a different healthcare system. Find contact information for your province or territory’s health ministry online for accurate, up-to-date information. This is your best resource for answering specific questions about eligibility and coverage based on your circumstances.

Accessing Healthcare Services: Navigating the System

Find a family doctor. This is your first step. Most provinces and territories have online search tools to locate doctors accepting new patients. Check your provincial or territorial health ministry website for this resource.

Use telehealth. Many services offer virtual appointments, saving you travel time. Check with your doctor or your provincial health authority’s website for available options. Telehealth is particularly useful for follow-ups or non-urgent issues.

Understanding Health Cards

Your provincial or territorial health card provides access to publicly funded healthcare. Keep it current and readily available. You will need it for appointments and services. Renew it as instructed by your provincial authority to avoid disruption of care.

Emergency Services

Dial 911 for immediate medical emergencies. Ambulances provide emergency transport to hospitals. This service is available across Canada.

For non-emergencies, consider walk-in clinics or urgent care centers. They offer faster access than emergency rooms for less urgent issues. Check online for clinic locations and hours.

Provincial Variations: Differences in Healthcare Delivery Across Canada

Canadians experience healthcare differently depending on their province or territory. Waiting times for specialist appointments, for example, vary considerably. British Columbia frequently reports shorter wait times for orthopedic surgeries than Quebec or Newfoundland and Labrador. This disparity stems from differing resource allocation and healthcare system management strategies.

Access to specific services also varies. Manitoba boasts a robust telehealth program, providing remote consultations, while other provinces are still developing comparable infrastructure. This directly impacts rural populations’ access to timely healthcare.

Funding models differ, affecting healthcare worker salaries and service availability. Ontario’s physician compensation model differs significantly from that of Alberta, leading to variations in the number of doctors per capita and impacting specialist availability. These discrepancies influence patient access to certain medical specialties.

Prescription drug coverage varies substantially. Some provinces offer broader public drug plans than others, impacting out-of-pocket costs for patients. Saskatchewan, for instance, provides wider coverage than Prince Edward Island, resulting in different financial burdens for residents.

Provincial health ministries often set unique priorities, affecting investment in specific areas. Nova Scotia may prioritize mental health initiatives more heavily than other provinces, leading to a noticeable difference in the availability of mental health services and support programs.

Understanding these variations allows Canadians to make informed choices about their healthcare needs and access available resources in their province. Comparing provincial healthcare data provides a clear picture of these differences, empowering individuals to advocate for better healthcare in their respective regions.

Prescription Drug Coverage: Understanding the Gaps in the System

Canadians face significant prescription drug cost challenges. Many lack complete coverage, leaving them with substantial out-of-pocket expenses.

Provincial Programs: A Patchwork Approach

Provincial and territorial drug plans vary considerably. Some offer broader coverage than others, leading to inequities across the country. For example, Ontario’s public drug plan doesn’t cover all medications for all residents, leaving many vulnerable.

- Consider your province’s specific drug plan details. Eligibility criteria and covered medications differ. Check your provincial government’s website for the most accurate information.

- Explore available assistance programs. Many organizations offer financial help to those struggling to afford prescriptions. Trillium Drug Program (Ontario) and similar provincial programs are examples.

- Negotiate with your pharmacist. Pharmacies often offer discounts or payment plans. Ask about options.

The Private Insurance Landscape

Employer-sponsored insurance plans frequently have gaps in coverage. Many plans impose deductibles, co-pays, and formularies that limit drug choices. This can result in substantial costs for employees.

- Review your insurance policy carefully. Understand your coverage limitations, including specific drugs covered and out-of-pocket maximums.

- Ask your employer about plan enhancements. Some employers offer supplemental plans or negotiate better rates with pharmaceutical companies.

- Compare private insurance options. If you’re self-employed or your current coverage is inadequate, investigate different private insurance providers to find more comprehensive coverage.

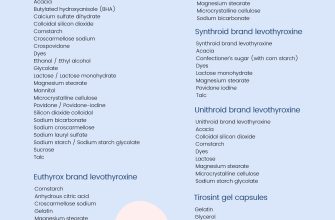

High-Cost Medications: A Major Concern

Many life-saving medications, such as biologics and specialty drugs, remain unaffordable for many Canadians, even with insurance. This often leads to delayed treatment or treatment abandonment.

- Explore patient assistance programs offered by pharmaceutical companies. Manufacturers sometimes provide financial aid for their expensive drugs. Check their websites for details.

- Advocate for policy changes. Contact your elected officials to push for broader, more equitable prescription drug coverage at the national level.

- Seek advice from healthcare professionals. Discuss affordable treatment alternatives with your doctor or pharmacist.

Addressing these gaps requires a multi-faceted approach, involving both individual action and broader policy reform. Proactive engagement and thorough understanding of your options are crucial for managing prescription drug costs effectively.

Funding and Sustainability: Challenges Facing Canadian Healthcare

Increase healthcare funding by 5% annually for the next decade. This investment addresses growing population demands and technological advancements.

Prioritize preventative care. Investing in public health initiatives, such as promoting healthy lifestyles and early detection programs, reduces long-term healthcare costs. Studies show that preventative measures can significantly lower hospital readmission rates by 15%, saving millions annually.

Addressing the Physician Shortage

Implement targeted recruitment strategies to attract and retain healthcare professionals, particularly in underserved areas. Offering competitive salaries and improved working conditions is crucial. Expanding medical school capacity by 20% over five years would directly impact this.

Encourage the adoption of telehealth. Expanding access to virtual care improves access for remote populations and reduces strain on in-person services. A recent study indicated a 20% reduction in wait times for specialist appointments through telehealth use.

Optimizing Resource Allocation

Enhance data collection and analysis to identify areas of inefficiency and optimize resource allocation. Data-driven decision-making improves overall system performance and reduces waste.

| Area | Current Spending (Billions CAD) | Proposed Increase (Billions CAD) |

|---|---|---|

| Hospital Care | 80 | 4 |

| Physician Services | 35 | 1.75 |

| Home Care | 20 | 1 |

Promote collaboration between healthcare providers. Streamlining information sharing and establishing clearer referral pathways enhances care coordination and reduces duplication of services.

Improving Drug Pricing

Negotiate better drug prices with pharmaceutical companies. This will lower healthcare expenses without compromising patient access to essential medications. Canada could save billions annually through price negotiations.

Explore alternative funding models, such as a dedicated healthcare tax. This ensures consistent and predictable funding, independent of annual budget fluctuations. This approach provides stability and allows for long-term strategic planning.

Alternative Healthcare Options: Private Insurance and Complementary Medicine

Consider supplementing your Canadian public healthcare with private insurance for faster access to specialists and diagnostic tests. Many private insurers offer plans covering services like MRI scans, specialist consultations, and physiotherapy, reducing wait times significantly. Compare plans carefully, focusing on coverage details and premiums to find the best fit for your needs and budget.

Complementary Medicine Options

Explore complementary medicine options like acupuncture, chiropractic care, massage therapy, and naturopathic medicine. While not covered under public healthcare, these therapies can address specific health concerns and promote overall well-being. Research practitioners carefully, checking their certifications and experience. Some extended health insurance plans may partially cover these services; check your policy details.

Finding Practitioners and Insurance

Utilize online directories to locate registered practitioners of complementary therapies in your area. Verify their qualifications and credentials independently. Contact your current insurance provider or explore other private insurance companies online to compare coverage options for both medical and complementary healthcare services. Remember to check whether your employer offers a group health plan, which may include extended health benefits.

Financial Considerations

Factor the cost of private insurance premiums and out-of-pocket expenses for complementary therapies into your healthcare budget. Evaluate the potential cost savings from quicker access to specialists or treatments compared to waiting for public healthcare services. Prioritize your needs and choose therapies and insurance coverage accordingly.